For most types of businesses, purchasing needed equipment is the largest expenditure. 8 out of 10 companies in the United States obtain some or all of their equipment through equipment lease financing, (American Association of Commercial Finance Brokers). Not only can large and well established businesses purchase equipment using equipment leasing, but also small and startup businesses.

WHY EQUIPMENT LEASE FINANCING?

Equipment leasing allows you to better use your existing capital. Also, credit issues not accepted by banks can be accommodated by equipment leasing financing institutions.

Better Use of Existing Funds

If you buy a piece, (or multiple pieces) of equipment outright, how much of a capital outlay do you need? The complete cost of the equipment, right? Thousands or tens of thousands of dollars. And the number of pieces of equipment you can purchase is limited to available cash on hand.

If you apply for an equipment loan at a bank, how much of a downpayment will you be required to pay? Normally, 20% to 30%. Again, thousands or tens of thousands of dollars. If you have a credit issue, then have a nice day. Also, if your business is less than two years old, then good day to you too.

How about equipment leasing? Usually a one month’s lease payment is all that is required to start the lease. Save the rest of your existing capital for other business needs OR acquire multiple pieces of needed equipment. Both will help to grow your business.

Many business equipment leasing financial institutions are able to provide financing despite credit issues you may have. They are able to provide financing for a larger pool of credit types. Instead of your credit score being their main consideration, many are able to look at your whole value as a company. They look at your sales and the hard assets you may have. Therefore, more businesses will qualify for leasing than a loan from a bank.

What if you are a new or startup business? Good news for you too! Some equipment leasing institutions will work with you.

Equipment Leasing Application is Simple

Most leasing applications are just two to four pages. Usually, not all lines apply to each applicant. Most business owners can fill them out in about ten to fifteen minutes. Even better, approvals usually take less than 24 hours. So, you can get your equipment quickly and put it to work.

Learn more about equipment lease financing and/or apply for a lease here.

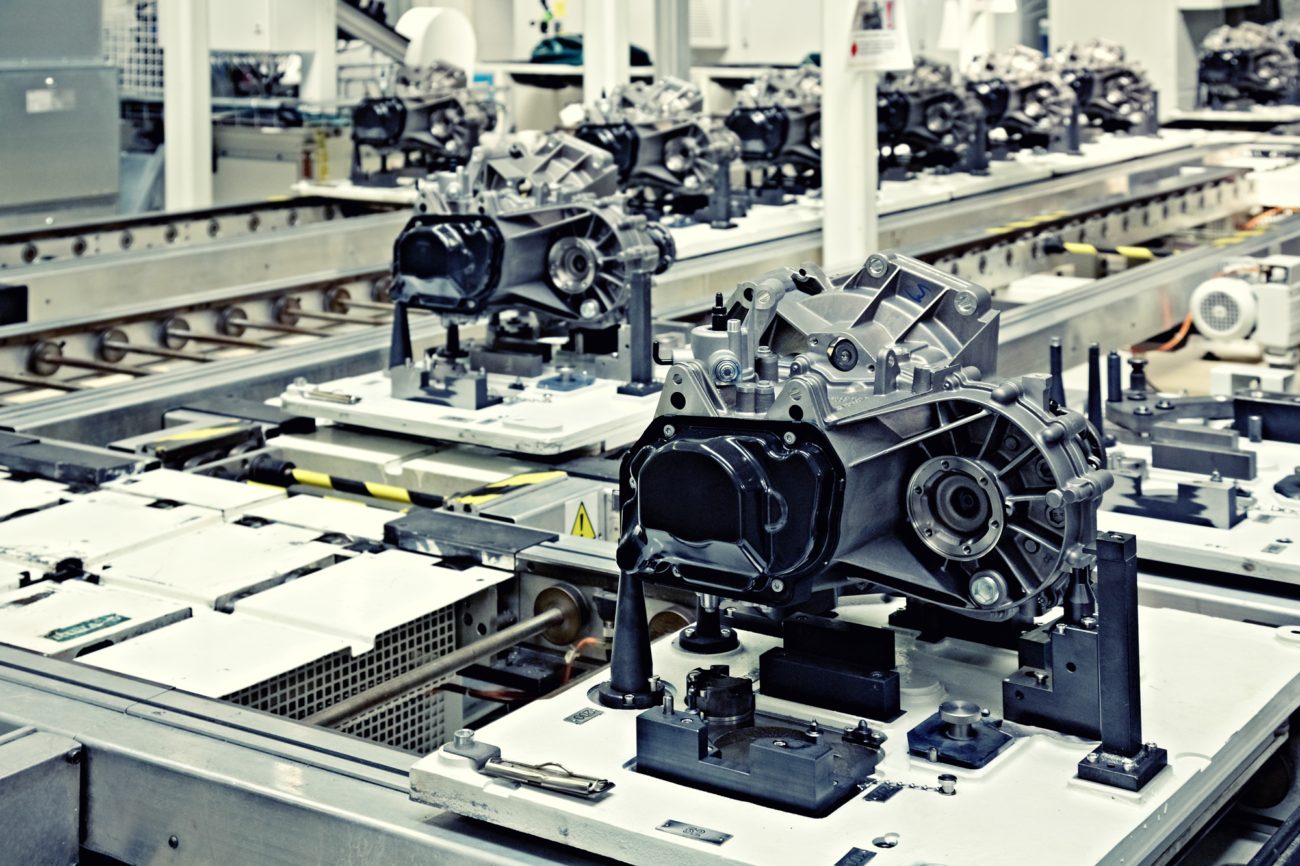

What types of equipment qualify for equipment leasing?

Equipment Leasing is available to the following types of businesses:

Large, Small, Well-Established, Startup, Growing, Credit Issues